Medical Bills Piling Up: What Workers Should Know About Coverage and Gaps

Few things feel as overwhelming as watching medical bills stack higher and higher after an accident at work. Even with insurance, it can be confusing to understand what gets covered and what slips through the cracks. That’s where workers’ compensation comes in. It’s designed to protect employees by covering medical costs tied to workplace injuries. Still, not every expense makes the cut. Knowing what’s included and what isn’t can help you plan ahead, avoid surprises, and decide if it’s time to call in https://www.workerscompensationattorneysacramento.net/ for help from workers compensation lawyers.

The Basics of Workers’ Compensation Coverage

Before diving into specifics, it’s important to recognize that workers’ compensation is a safety net. The system exists to make sure injured workers don’t get buried under financial stress while recovering. It’s also meant to reduce conflict between employees and employers by creating a clear path to coverage.

What Should Be Covered

When you get hurt on the job, there are several medical expenses that workers’ compensation usually pays for:

1. Emergency Care

If you need immediate medical attention, such as an ambulance ride or an ER visit, those costs are generally covered without question.

2. Hospital Stays and Surgeries

In cases where your injury requires a hospital stay, surgery, or other major treatments, workers’ comp typically takes care of those bills.

3. Doctor Visits and Specialist Care

Whether it’s routine checkups, follow-up appointments, or visits with specialists like orthopedic surgeons, these are standard parts of covered care.

4. Prescription Medications

Pain management, antibiotics, or other necessary prescriptions directly tied to your injury are often included.

5. Rehabilitation and Therapy

If your injury means you need physical therapy, occupational therapy, or even vocational retraining, those services may also be covered.

Fun fact: In some states, workers’ compensation may even cover alternative treatments like acupuncture if they are prescribed as part of your recovery plan.

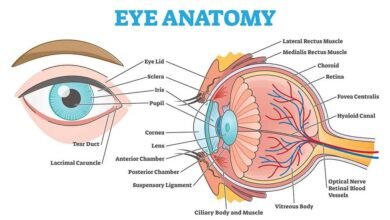

See also: Emergency Ambulance and Its Role in Healthcare

When Coverage Gets Complicated

The rules sound straightforward, but real life is rarely that simple. Workers often discover that coverage doesn’t automatically extend to every situation. This is where the details of your claim, your employer’s insurance, and your state’s laws can make a big difference.

What’s Not Usually Covered

Here are some of the most common expenses that workers’ compensation does not pay for:

● Experimental Treatments: If your doctor recommends a cutting-edge or unproven treatment, the insurance provider may deny coverage.

● Over-the-Counter Medications: Unless specifically prescribed, pain relievers or other non-prescription items are usually out-of-pocket.

● Unrelated Health Issues: If the insurer believes your medical problems existed before the accident or aren’t connected to your work injury, they may refuse payment.

● Cosmetic or Elective Procedures: Workers’ comp focuses on getting you back to health and back to work, not on covering procedures that are optional.

Fun fact: In ancient Mesopotamia, one of the first recorded “workers’ compensation” laws existed, where specific payments were listed for injuries to certain body parts. Talk about an early version of today’s system!

Why Legal Guidance Matters

Even though workers’ compensation is supposed to simplify the process, many injured workers find themselves in disputes over what’s covered. This is where consulting with a workers’ compensation lawyer can make all the difference. A good lawyer can help you:

● Navigate denied claims.

● Prove that your injury is directly related to your work.

● Push back if the insurance company tries to limit your treatment options.

● Ensure you receive not just medical coverage but also wage replacement if you’re unable to work.

Having an advocate levels the playing field against large insurance companies who are often more focused on minimizing costs than protecting your well-being.

Beyond the Bills

It’s easy to think of workers’ compensation as just a financial safety net, but it’s more than that. It’s about protecting your physical health, your ability to return to work, and even your mental peace of mind. The stress of juggling unpaid bills can slow down recovery, and that’s exactly what the system is meant to prevent.

Fun fact: Studies show that employees who feel supported and fairly treated during the claims process often recover faster than those who feel ignored or dismissed.

Medical bills don’t just disappear on their own, and hoping they will only adds stress to an already difficult time. Understanding what’s covered under workers’ compensation, and where the gaps exist, can help you stay prepared. And if you run into roadblocks, remember that workers’ compensation lawyers are not just problem-solvers; they’re protectors of your rights.

In the end, knowing your options is the first step to keeping both your finances and your health on track.